The Union Budget 2026-27, presented by Finance Minister Nirmala Sitharaman, is a comprehensive blueprint for Viksit Bharat, guided by the principle of “Action Over Ambivalence, Reform Over Rhetoric,People Over Populism”. Read more about the key highlights, facts and important data for APSC/UPSC Prelims and Mains.

The Historical Evolution of the Indian Budget

The concept of a formal budget in India dates back to April 7, 1860, when it was introduced by James Wilson, a Scottish economist and politician from the East India Company, for the British Crown. The first Union Budget of an independent India was presented on November 26, 1947, by the nation’s first Finance Minister, Sir R.K. Shanmugham Chetty.

Key Facts you should not Miss

Definition: It is a statement of the estimated receipts and expenditure of the Government of India for a financial year, which runs from 1 April to 31 March of the following year. The term “budget” is not used anywhere in the text of the Constitution itself. The Constitution of India refers to the budget as the “Annual Financial Statement” under Article 112.

Maximum Budget Presented by

- Morarji Desai – 10 times

- Nirmala Sitharaman- 9 times

- P. Chidambaram – 9 times

Longest Budget Speech

- Words- Dr. Manmohan Singh, 18,650 words ( 1991 Budget)

- Duration- Nirmala Sitharaman, 2.42 hrs ( 2020 budget)

Theme 2026: Vikshit Bharat, balancing ambition with Inclusion

Key highlights of budget 2026

Union Budget 2026 is the first budget prepared in the newly designated Kartavya Bhawan, inspired by 3 Kartavyas:

- Economic Growth: Accelerate and sustain growth by enhancing productivity and resilience to global dynamics.

- Capacity Building: Fulfill citizen aspirations and build their capacity as partners in prosperity.

- Sabka Sath, Sabka Vikas: Ensure universal access to resources and opportunities across every region and sector.

The Budget emphasizes a Yuva Shakti-driven approach focused on the poor, underprivileged, and disadvantaged.

Macro-Fiscal Strategy and Debt Sustainability

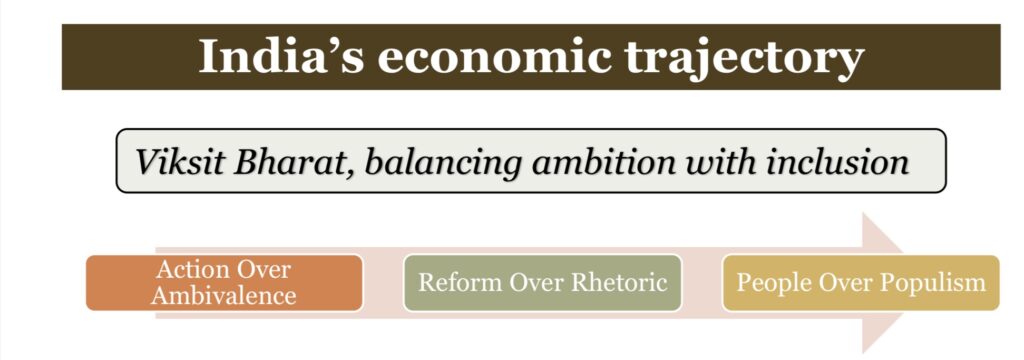

Fiscal Deficit: Targeted at 4.3% of GDP for 2026-27, down from 4.4% in the previous year.

Debt Reduction: Aims to reduce the debt-to-GDP ratio to 50% (±1%) by 2030-31; it is estimated to reach 55.6% by the end of FY 2026-27.

Growth Projections: Real GDP growth is projected at 7.4% for FY26, with nominal growth at 10% for FY27.

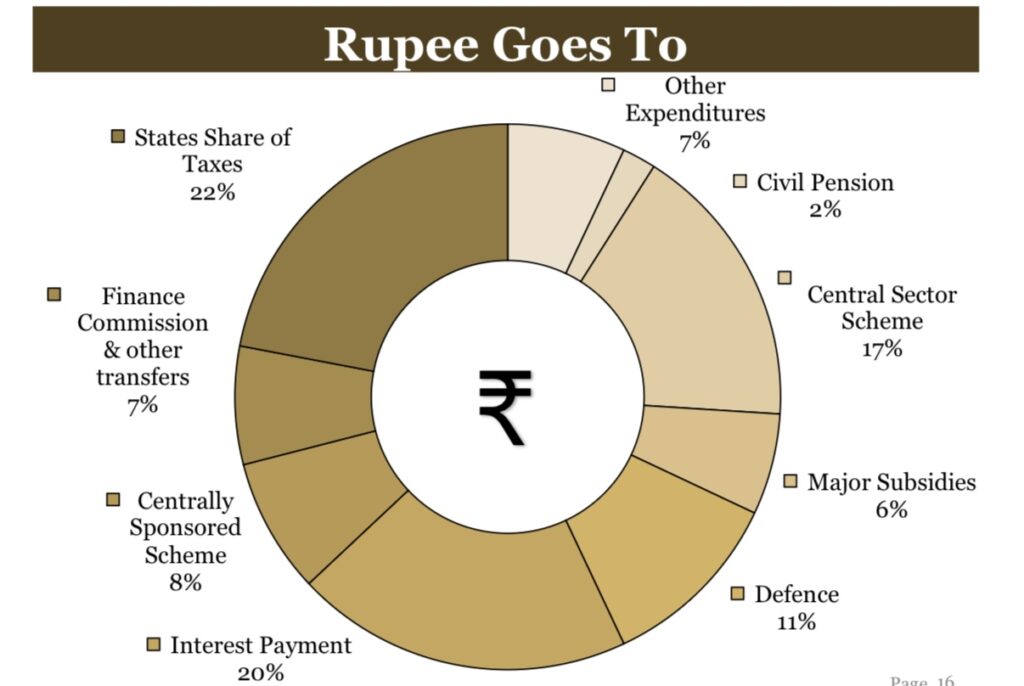

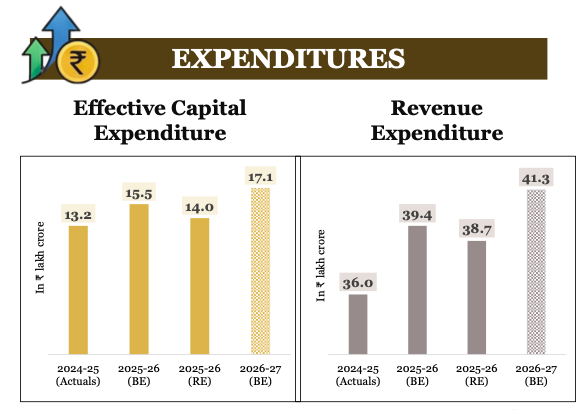

Expenditure: Total expenditure is pegged at ₹53.47 lakh crore, with Capital Expenditure rising to ₹12.22 lakh crore (3.1% of GDP).

Legislative Transformation: Income Tax Act, 2025

The budget introduces the Income Tax Act, 2025, replacing the 1961 Act effective April 1, 2026.

- Simplification: Reduces the code to 536 clauses and removes over 1,200 provisos to curb litigation.

- Tax Year: Aligns with international standards by replacing “Previous Year” with a unified “Tax Year”.

- Individual Relief:

- TCS Reduction: Remittances for education and medical purposes cut from 5% to 2%.

- Overseas Tours: Tax Collected at Source standardized at 2% without a minimum threshold, significantly reducing the immediate cash flow burden in middle class families.

The GYAN Strategy: Demographic and Social Inclusion

The budget prioritizes four pillars:

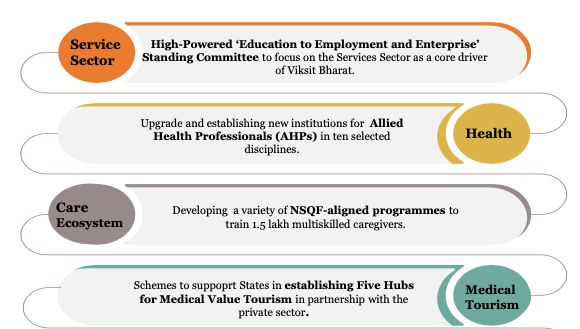

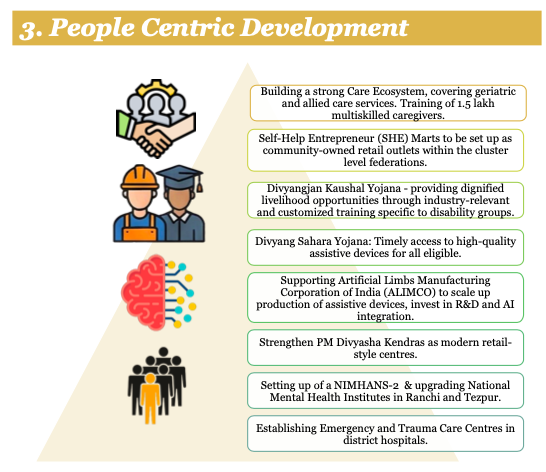

- Garib (Poor): Focuses on mental health with establishment of NIMHANS-2 in North India and upgrading of mental health institutes in Tezpur and Ranchi and brings one crore gig workers under social security through registration on the e- Shram portal and inclusion in PM Jan Arogya Yojana.

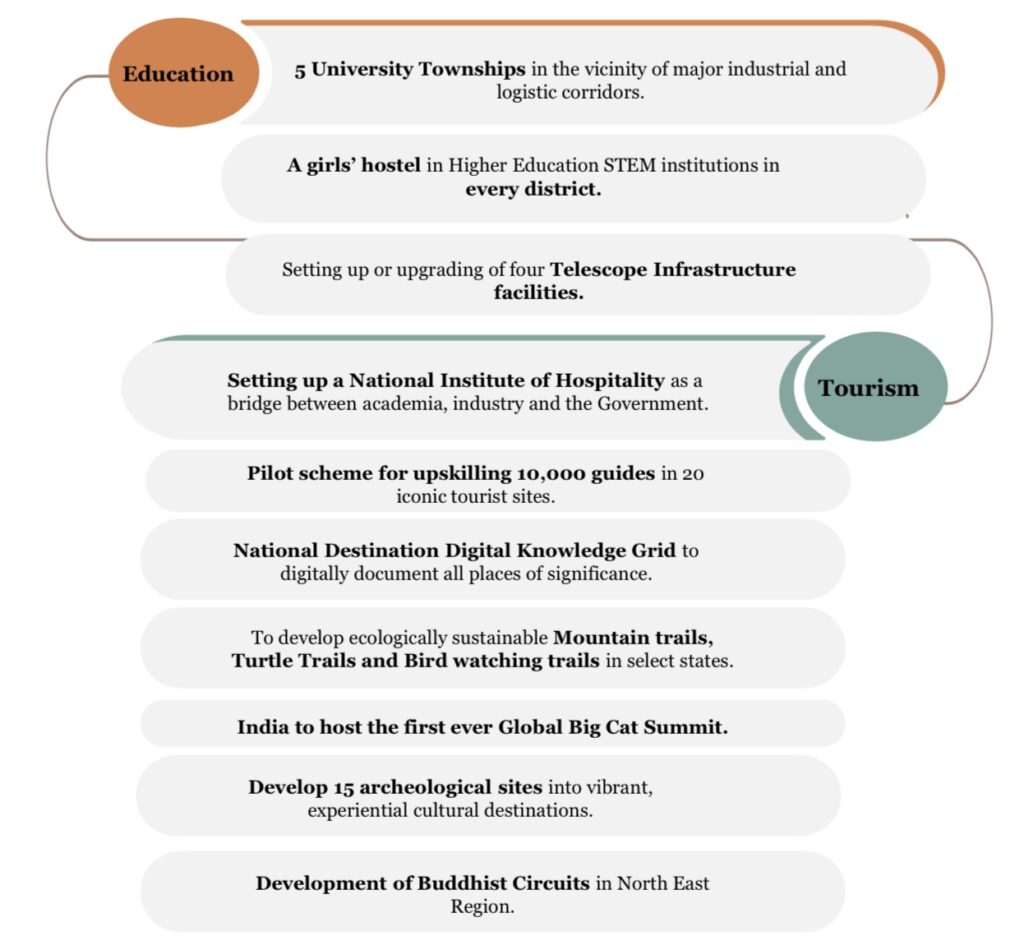

- Yuva (Youth): Supports the “Orange Economy” and India’s digital future with labs in 15,000 schools and 500 colleges and expands the Khelo India Mission.

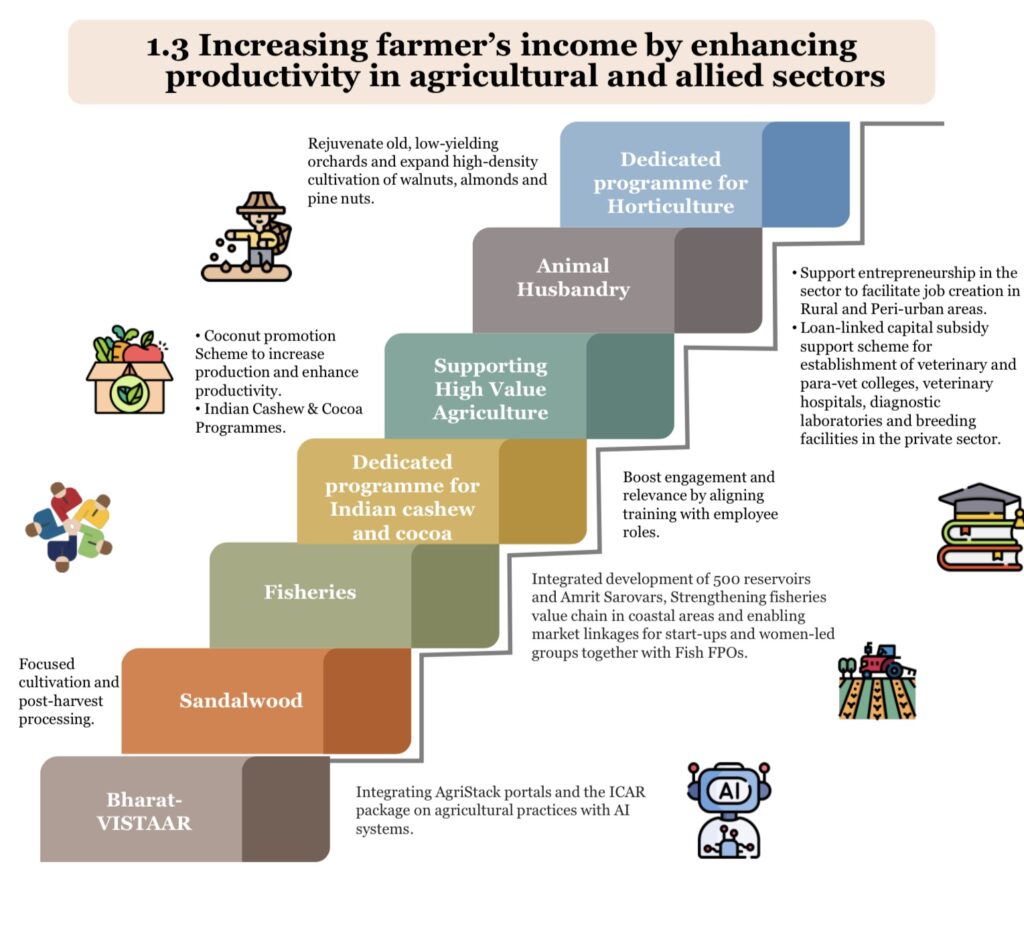

- Annadata (Farmers): Launches “Bharat-VISTAAR” (an AI tool for farmers) and the “Mission for Aatmanirbharta in Pulses.” The KCC loan limit is raised from ₹3 lakh to ₹5 lakh.

- Nari (Women): Establishes girls’ hostels in every district for STEM students and creates “SHE Marts( self-help Entrepreneur Marts)” for women-led retail outlets.

Industrial Policy and Manufacturing Strategy

A renewed push for domestic manufacturing focuses on seven frontier sectors.

| Frontier Sector Initiative | Key Focus Area | Allocation / Outlay |

|---|---|---|

| Biopharma SHAKTI | Biologics, Biosimilars, Clinical Trials | ₹10,000 cr (5 years) |

| ISM 2.0 | Chip Equipment, Indian IP, full-stack design | – |

| Electronics Components | Deepening local value addition | ₹40,000 cr |

| Rare Earth Corridors | Mining and processing in Odisha, KL, AP, TN | – |

| Container Manufacturing | Building a global ecosystem for maritime trade | ₹10,000 cr (5 years) |

| National Fibre Scheme | Self-reliance in silk, wool, jute, and new-age fibres | – |

| Nuclear Modular | R&D for small-scale energy unitsReactors | ₹20,000 cr |

Infrastructure and Logistics: The Foundation for Growth

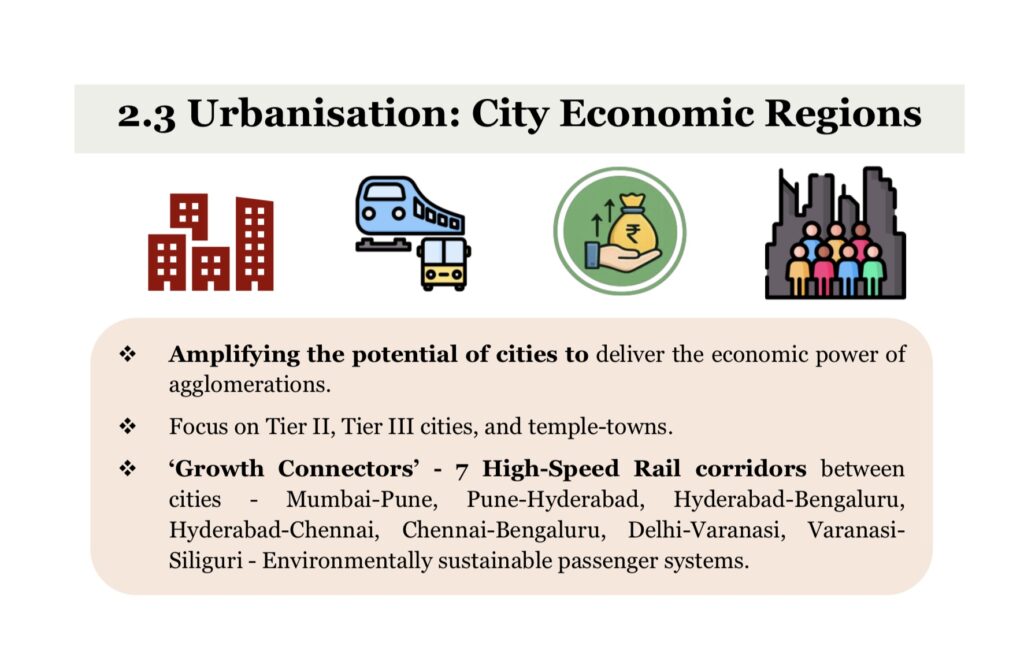

- A flagship announcement is the development of seven high speed rail corridors to serve as ‘growth connectors’ between major urban hubs.

- Mumbai – Pune

- Pune – Hyderabad

- Hyderabad – Bengaluru

- Hyderabad – Chennai

- Chennai – Bengaluru

- Delhi – Varanasi

- Varanasi – Siliguri

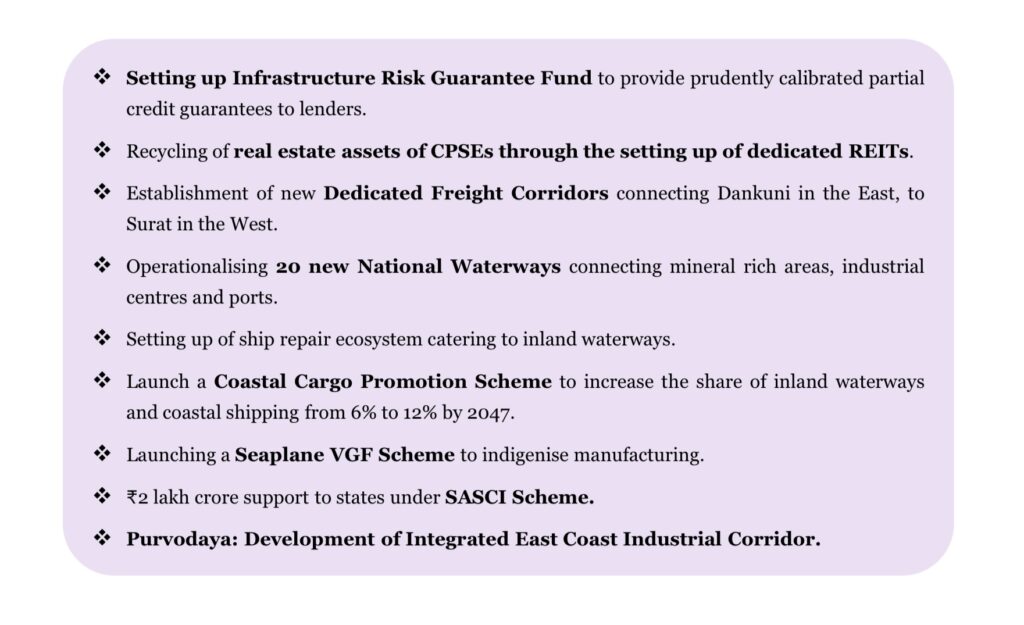

- Logistics: A new Dedicated Freight Corridor (Dankuni, East to Surat, West) and operationalizing 20 new National Waterways.

- Urban Growth: Mapping City Economic Regions (CERs) with a ₹5,000 crore allocation per region to transform Tier-II and Tier-III cities and temple towns.

Rural Welfare

- Viksit Bharat- Guarantee for Rozgar and Ajeevika Mission (Gramin) (VB-G RAM G) Act replaces MGNREGA, increasing guaranteed work to 125 days but shifting the funding ratio to 60:40 (Centre:State).

- To maintain the legacy of Mahatma Gandhi in rural welfare, the budget separately launched the “Mahatma Gandhi Gram Swaraj Initiative,” focusing on strengthening khadi, handloom, and handicrafts through global branding and market linkages.

Energy Transition and Environmental Sustainability

- The budget reinforces India’s commitment to energy security and climate goals through a blend of R&D investment and fiscal incentives.

- Nuclear Energy Mission: A ₹20,000 crore outlay has been proposed for the research and development of Small Modular Reactors (SMRs), highlighting nuclear power as a strategic component of the base-load energy mix.

- Green Logistics: The government aims to double the share of inland waterways and coastal shipping by 2047, starting with the Coastal Cargo Promotion Scheme.

- Bio-Energy Push: Phased blending of Compressed Bio-Gas (CBG) into CNG for transport has been announced, cutting fossil fuel dependence and emissions.

- Critical Mineral Support: Customs duty exemptions for capital goods used in processing critical minerals and manufacturing lithium-ion cells have been extended, providing a boost to the EV and renewable energy sectors.

Comparative Analysis of the 2025-2026 and 2026-2027 Union Budgets

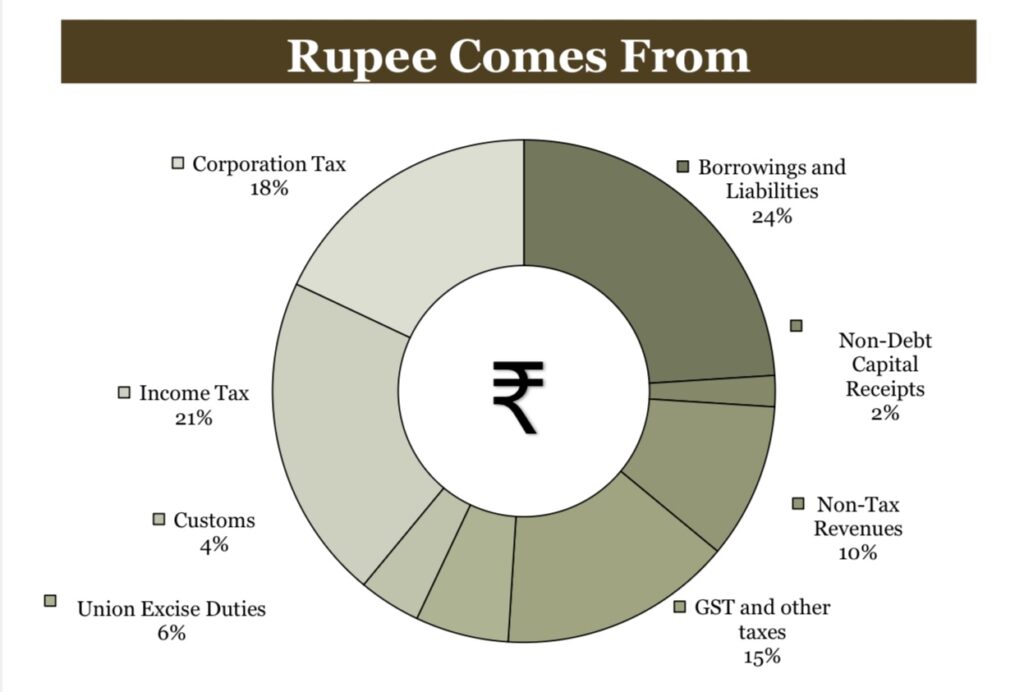

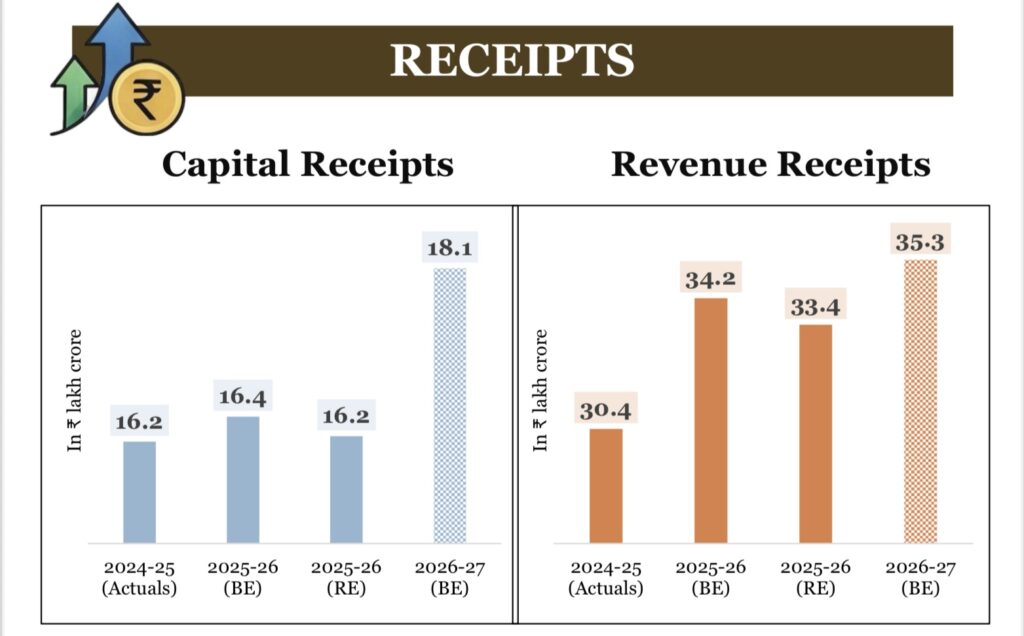

Comparative Fiscal Aggregates and Trends

| Parameter | 2025-26 (BE) | 2025-26 (RE) | 2026-27 (BE) |

|---|---|---|---|

| Total Expenditure | ₹50,65,345 crore | ₹49.6 lakh crore | ₹53.5 lakh crore |

| Capital Expenditure | ₹11.21 lakh crore | ₹11.0 lakh crore | ₹12.2 lakh crore |

| Effective CapEx | ₹15,48,391 crore | ₹14.0 lakh crore | ₹17.1 lakh crore |

| Total Receipts (Excl. Borrowings) | ₹34,96,409 crore | ₹34.0 lakh crore | ₹36.5 lakh crore |

| Net Tax Revenue | ₹28,37,409 crore | ₹26.7 lakh crore | ₹28.7 lakh crore |

| Fiscal Deficit (% of GDP) | 4.4% | 4.4% | 4.3% |

| Revenue Deficit (% of GDP) | 1.5% | – | – |

| Primary Deficit (% of GDP) | 0.8% | – | – |

| Debt-to-GDP Ratio | 56.1% | 56.1% | 56.1% |

The Evolution of Manufacturing Missions

| Focus Area | 2025–26 Strategic Moves | 2026–27 Strategic Acceleration |

|---|---|---|

| Semiconductors | Initial ISM support; critical mineral duty cuts | ISM 2.0 (₹40,000 cr) covering equipment, materials, and IP |

| Electronics | Customs duty cuts on battery parts and open cells | Outlay for Electronics Component Scheme raised to ₹40,000 cr |

| Biotechnology / Pharma | Focus on general pharmaceutical manufacturing | Biopharma SHAKTI (₹10,000 cr) for high-end research |

| Chemicals | Inclusion under National Manufacturing Mission | Three dedicated Chemical Parks via challenge mode |

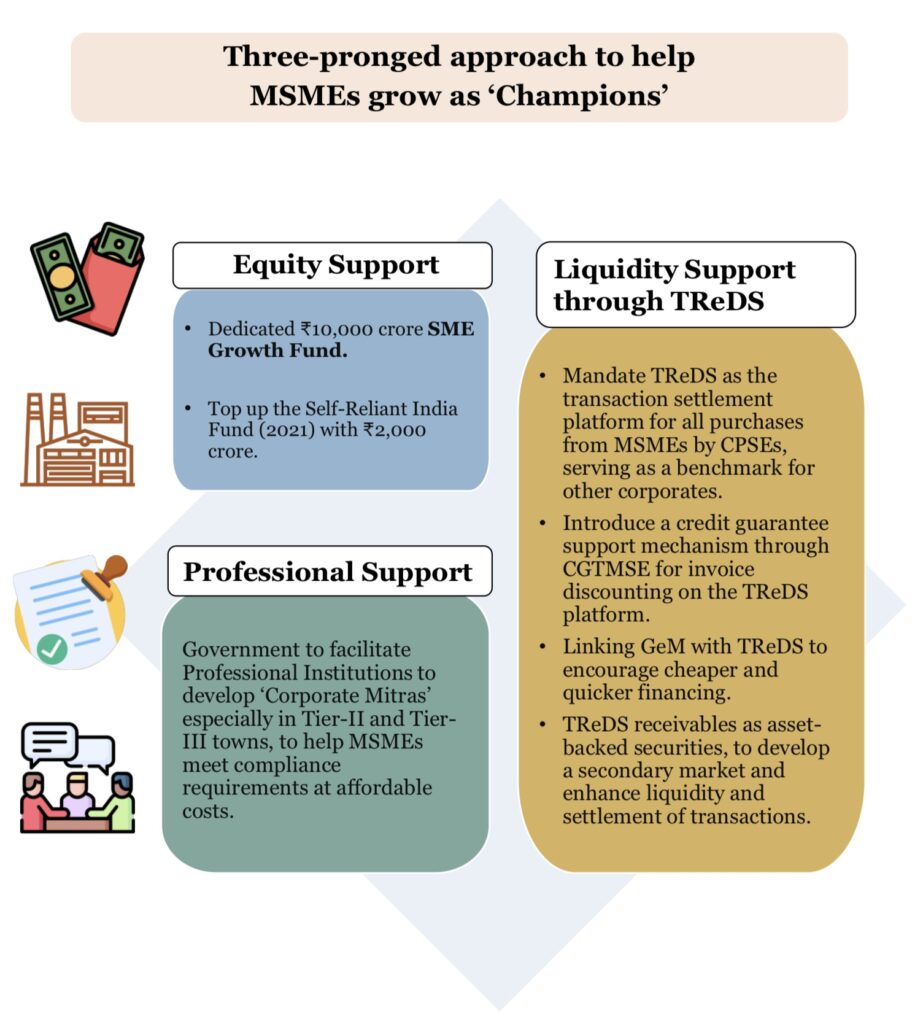

| Legacy Sectors / MSMEs | MSME credit guarantee support | Revival of 200 legacy industrial clusters (₹10 cr) |

Connectivity and Logistics Infrastructure

| Infrastructure Item | 2025–26 Milestones | 2026–27 New Initiatives |

|---|---|---|

| Railways | Expansion of Dedicated Freight Corridors (96% commissioned by Oct 2025) | 7 High-Speed Rail corridors; DFC node at Surat |

| Waterways | Maritime Development Fund (₹25,000 cr) | 20 new National Waterways; ship-repair facilities at Varanasi & Patna |

| Urban Transport | Urban Challenge Fund – initial allocation (₹10,000 cr) | Provision for 4,000 e-buses; creation of City Economic Regions |

| Rural Water | Jal Jeevan Mission extended to 2028 | 100% rural water coverage target; Jan Bhagidhari in O&M |

Agricultural Support and Rural Credit

| Scheme / Allocation | 2025–26 Target / Level | 2026–27 Target / Level |

|---|---|---|

| PM-Kisan | ₹60,000 crore (approx.) | ₹63,500 crore (Target: 9.5 crore farmers) |

| KCC Loan Limit | Enhanced from ₹3 lakh to ₹5 lakh | Continued focus on credit-linked subsidies |

| Pulses / Oilseeds | 6-year self-reliance mission | Natural Fibre Scheme; Coconut & Cashew missions |

| Fisheries | Expansion of Pradhan Mantri Matsya Sampada Yojana | Integrated development of 500 reservoirs / Amrit Sarovars |

| Rural Development | ₹2.66 lakh crore | ₹2.73 lakh crore |

Evolution of Direct Tax Policies

| Tax Provision | 2025–26 Reform | 2026–27 Further Refinement |

|---|---|---|

| Income Tax Slabs | Slabs rationalized; rebate up to ₹12 lakh | Slabs maintained; Section 87A rebate unchanged |

| Corporate Tax | Focus on startup tax exemptions extended up to 2030 | MAT reduced to 14% and made a final tax |

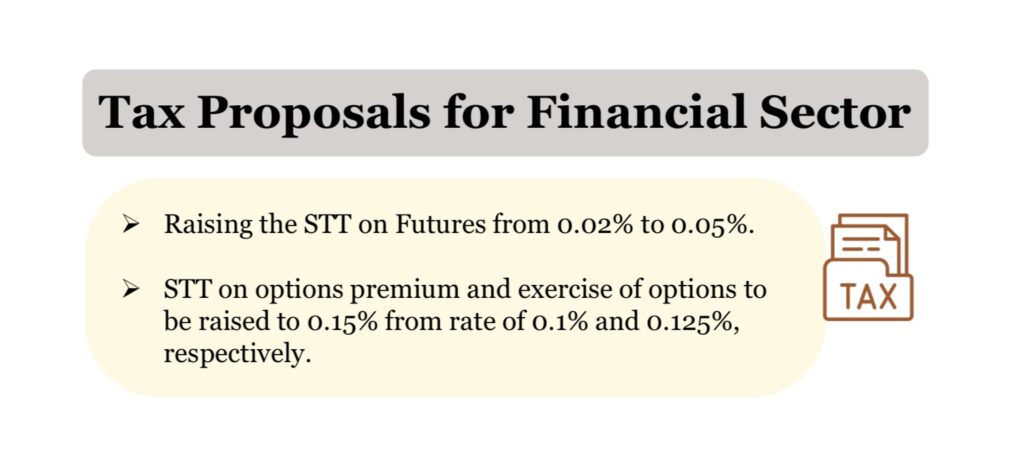

| Securities Transaction Tax (STT) | No major change | Futures: 0.05%, Options: 0.15% |

| Buybacks | No major change | Buybacks treated as Capital Gains for shareholders (22% / 30%) |

| Compliance / Returns | Revised return time-limit extended to 4 years | Return update allowed even after reassessment with additional 10% tax |

Social Infrastructure Highlights

| Category | 2025–26 Commitments | 2026–27 Expansions |

|---|---|---|

| Healthcare | 10,000 medical seats; 200 Cancer clinics. | NIMHANS-2.0; 50% expansion in emergency/trauma care. |

| Education | CoE in AI for Education (₹500 cr). | “Orange Economy” Content Creator Labs in 15k schools. |

| Youth/Skills | National Centres of Excellence for Skilling. | Khelo India Mission; 1 lakh Allied Health Professionals. |

| Women (Nari) | Term-loans for 5 lakh women entrepreneurs. | “She-Mark” and “She-Marts” (retail outlets). |

| Health R&D | NIPER infrastructure focus. | New NIPERs; Biopharma SHAKTI. |

Green Energy and Environmental Policy

| Policy / Mission | 2025-26 Focus | 2026-27 Focus |

|---|---|---|

| Nuclear Power | SMR R&D (₹20,000 cr); Atomic Energy Act changes. | Goal of 100 GW by 2047; BCD exemption for projects till 2035. |

| Carbon Management | General green transition mentions. | CCUS Mission (₹20,000 cr over 5 years). |

| Renewable Inputs | BCD cuts on solar cell parts and critical minerals. | BCD exemption for sodium antimonate (solar glass). |

| Alternative Fuels | Incentives for electricity distribution reforms. | Excise duty exclusion for biogas in blended CNG. |

| Pollution Control | General urban sanitation focus. | “Control of Pollution” dedicated allocation (₹1,091 cr) |

Synthesized Conclusions on the 2025-2027 Continuum

The comparative analysis of the Union Budgets for 2025-26 and 2026-27 reveals a cohesive, multi-year economic strategy that is both disciplined and ambitious. The government has successfully transitioned from a period of “post-pandemic normalisation” to one of “structural transformation.” This continuum is defined by several core themes:

- Fiscal Integrity: The glide path from a 4.4% deficit in 2025-26 to a 4.3% target in 2026- 27, while increasing Effective Capital Expenditure to ₹17.1 lakh crore, represents a sophisticated management of the sovereign balance sheet.

- High-Tech Atmanirbharta: The journey from securing critical minerals in 2025 to launching ISM 2.0 and Biopharma SHAKTI in 2026 signals a move toward high-value manufacturing and intellectual property creation.

- Governance through Trust: The enactment of the “New Income Tax Act, 2025” and the introduction of “Corporate Mitras” represent a systemic shift from a suspicious regulatory stance to a trust-based, compliance-friendly ecosystem.

- Inclusive Human Capital: The move from adding medical seats to training a specialized “Caregiver” workforce and launching a dedicated “Orange Economy” content lab network shows a forward-looking approach to job creation in the digital and silver economies.

- Strategic Connectivity: The integration of High-Speed Rail corridors with City Economic Regions and the East Coast Industrial Corridor ensures that infrastructure serves as a multiplier for economic activity rather than just a physical asset.

Ultimately, these two budgets represent the “Kartavya” (Duty) of the state to build the foundations of a “Viksit Bharat” by balancing the immediate needs of the poor and middle class with the long-term imperative of global technological leadership and fiscal sustainability. The 2026-27 budget’s motto—”Action Over Ambivalence”—is the logical progression of the 2025- 26 budget’s structural reforms, ensuring that the momentum of the Indian economy remains resilient in the face of global uncertainties.

LUCENT IAS APSC/ UPSC Mains Practice Question

Q. The Union Budget 2026-27 is anchored by the concept of ‘Three Kartavyas’ (Duties). Briefly explain these duties and discuss how the budget aims to empower the ‘Yuva’ (Youth) and ‘Annadata’ (Farmers) under this framework. (Write in 150 words) 10

LUCENT IAS APSC/ UPSC Prelims FAQs

Q. With reference to the Union Budget 2026-27, consider the following statements:

- The fiscal deficit target for FY 2026-27 is pegged at 4.5% of GDP.

- The government aims to reduce the debt-to-GDP ratio to 50% (±1%) by the fiscal year 2030-31.+1

- Nominal GDP growth for 2026-27 is estimated at 10.0%.

Which of the statements given above are correct?

A) 1 and 2 only

B) 2 and 3 only

C) 1 and 3 only

D) 1, 2, and 3

Correct Answer: B

Explained: Statement 1 is incorrect because the fiscal deficit target for 2026-27 is 4.3%.

Q.Consider the following statements regarding the budgetary process in India:

- The term ‘Budget’ is explicitly mentioned under Article 112 of the Indian Constitution.

- The Railway Budget was merged with the General Budget in 2017, ending a practice started based on the Acworth Committee recommendations.

- No demand for a grant can be made in Parliament except on the recommendation of the President.

Which of the statements given above is/are correct?

A) 2 only

B) 1 and 3 only

C) 2 and 3 only

D) 1, 2, and 3

Correct Answer: C

Explained: Statement 1 is incorrect because the Constitution uses the term “Annual Financial Statement”. Statement 2 is correct (merged in 2017). Statement 3 is a mandatory constitutional provision.

Watch the full video on YouTube

About Lucent IAS

Lucent IAS is a premier coaching institute in Guwahati, dedicated to empowering APSC aspirants with a result-oriented approach. Recognized as a top destination for APSC Coaching, we offer comprehensive guidance ranging from Foundation Courses and Advanced Mains preparation to our signature Assam-Centric study modules. With expert faculty, small batch sizes for personalized mentoring, and the acclaimed Saadhana Test Series, Lucent IAS is committed to helping you crack the Civil Services Examination.

Publications From LUCENT IAS

- “The Assam Odyssey: The Complete Assam Centric Resource useful for APSC CCE and various other Departmental Examinations. Read More

- InExam PYQ Explained.Read More

- Mains Tattva: The Craft of Answer Writing (GS Paper PYQs). Read More

- Maanchitra – An Illustrative Colour-Coded Informative Map of Assam. Read More

- প্ৰাৰম্ভ (Prarambha). Read More

- অসম ওডিচী – The Assam Odyssey (Assamese Edition). Read More

Start your journey to success today. Visit us at lucentias.com or call +91-6913007777 for more details.