Released on January 29, 2026, the Economic Survey 2025-26 stands as the definitive institutional assessment of India’s macroeconomic landscape. Presented by Union Finance Minister Nirmala Sitharaman, this landmark document serves as the strategic framework for policy decisions and reform philosophy preceeding the Union Budget 2026-27. Read more about the key highlights, facts and important trends for APSC/UPSC Prelims and data for Mains.

Basics of Economic Survey

Originally introduced in 1950–51 as part of the Union Budget documents, the Survey was separated in 1964 to serve as an independent, objective review of economic developments.

The Economic Survey 2026, released on 29th January 2026, continues a long-standing tradition of providing an official institutional assessment of the Indian economy before the presentation of the Union Budget on 1st February. Prepared by the Department of Economic Affairs under the guidance of Chief Economic Adviser V. Anantha Nageswaran, this document represents the government’s core reform philosophy and policy priorities.

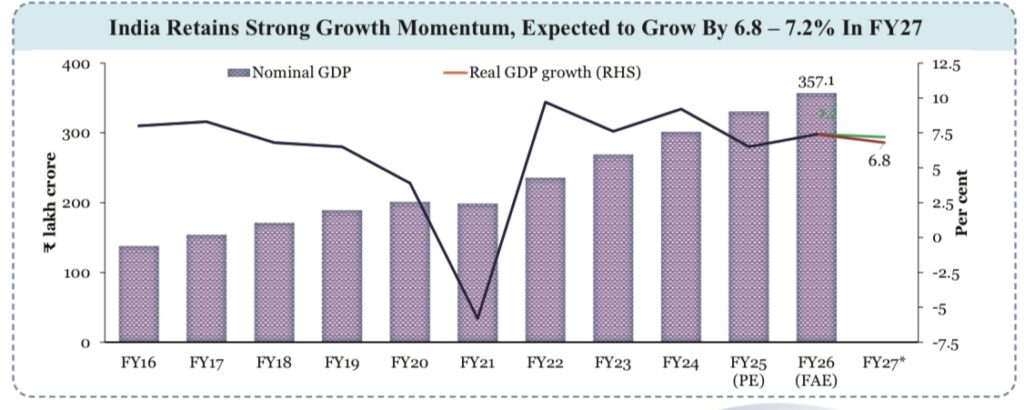

State of the Economy: Pushing the Growth Frontier

- Growth Outlook: India remains the fastest-growing major economy, with a projected real GDP growth of 6.8–7.2% for FY27.

- Momentum Drivers: Growth is fueled by a revival in private investment and strong private consumption, which is estimated at 61.5% of nominal GDP for FY26.

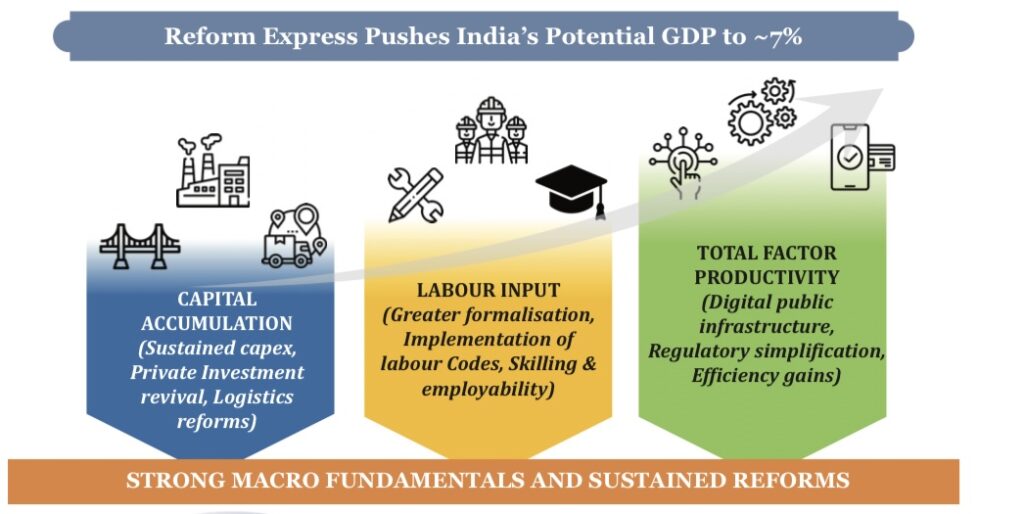

- Supply-Side Boost: Potential GDP is being pushed toward 7% through capital accumulation, logistics reforms, and digital public infrastructure.

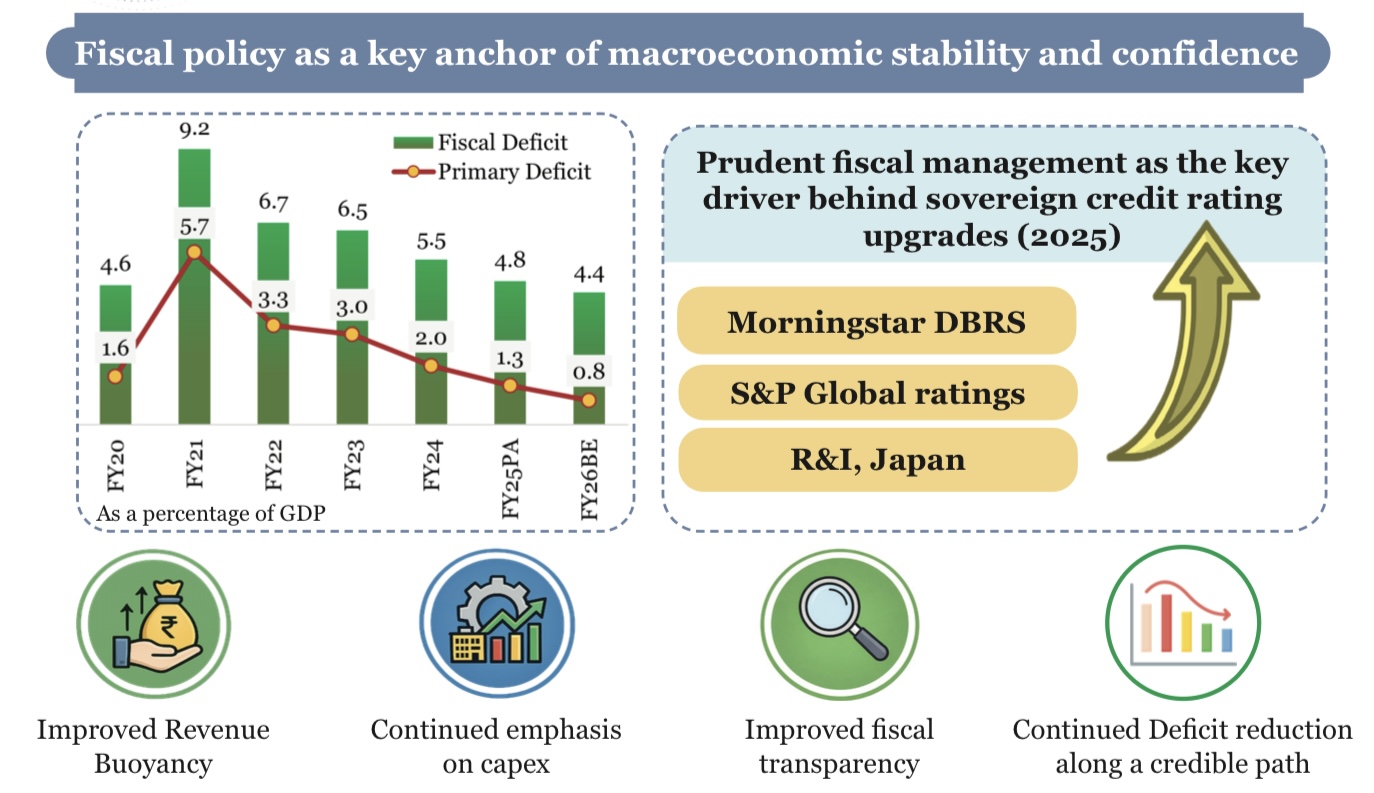

Fiscal Developments: Anchoring Stability through Credible Consolidation

- Credible Consolidation: The fiscal deficit has been reduced from 9.2% in FY21 to a projected 4.4% in FY26.

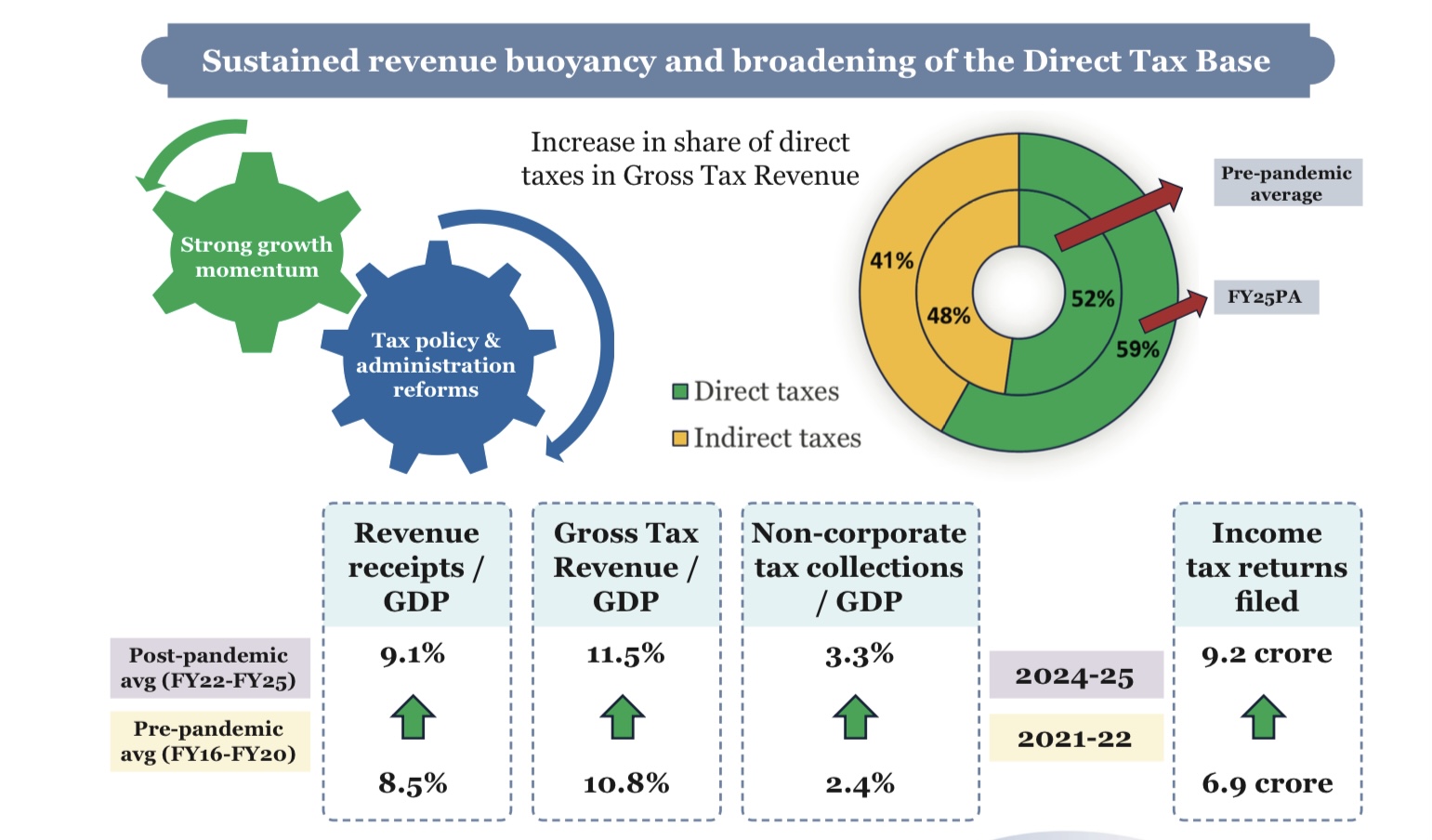

- Revenue Buoyancy: Direct taxes as a share of Gross Tax Revenue increased from a 52% pre-pandemic average to 59% in FY25PA.

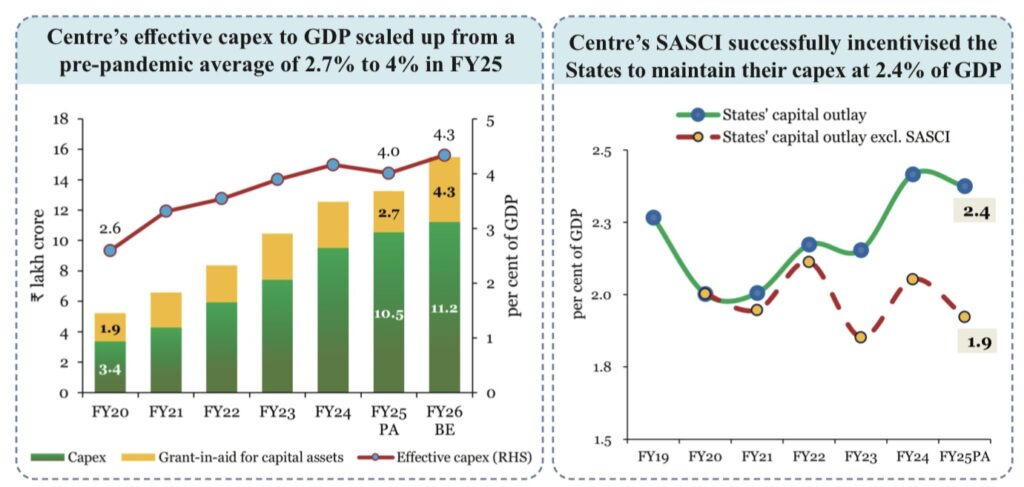

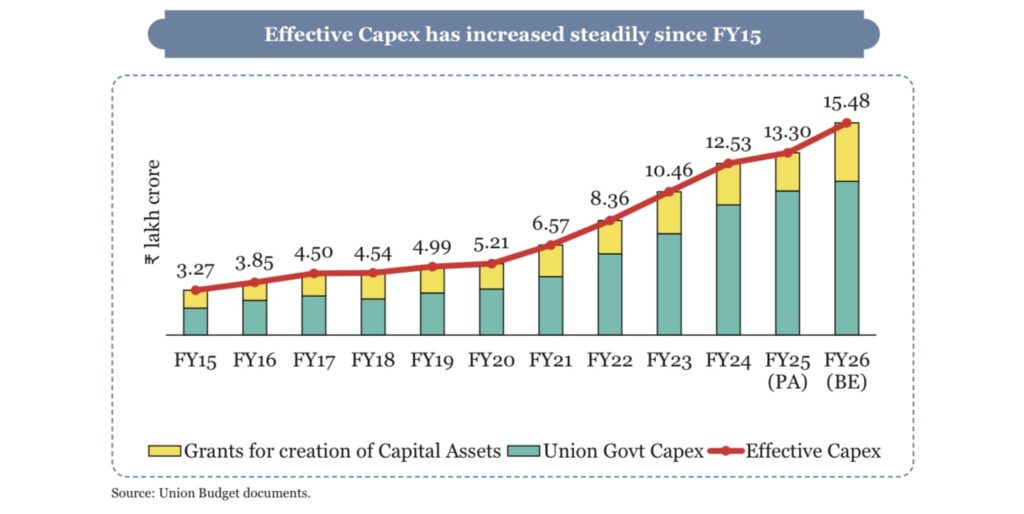

- Capex Focus: Central effective capex has scaled up to 4% of GDP in FY25, compared to a 2.7% pre pandemic average.

- Gross GST collections (April–December 2025) stood at ₹17.4 lakh crore, registering 6.7% year-on-year growth.

- India reduced its general government debt-to-GDP ratio by 7.1 percentage points since 2020, while maintaining high public investment.

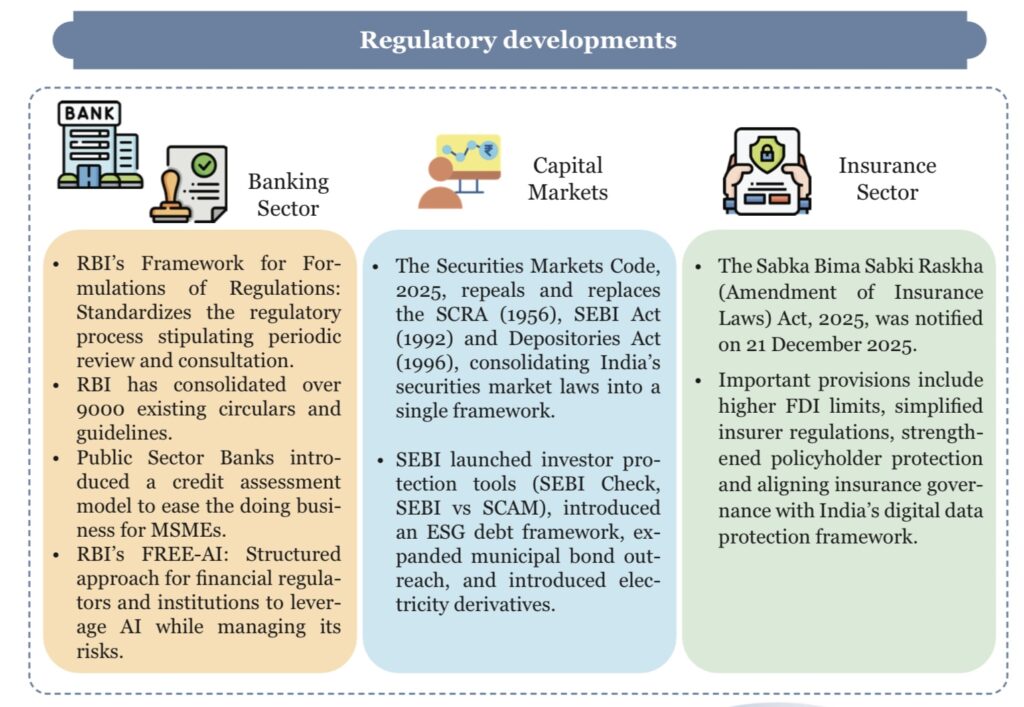

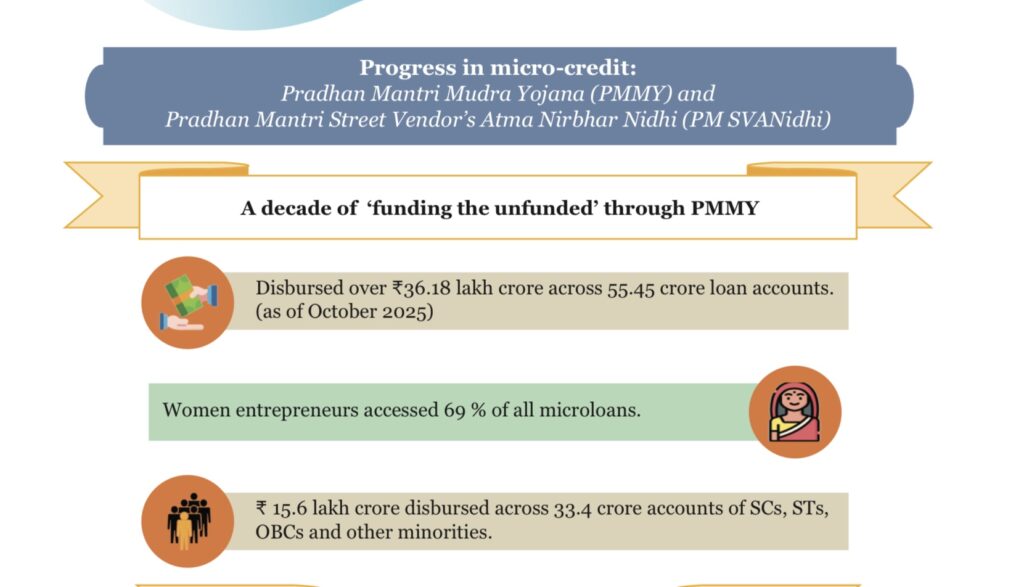

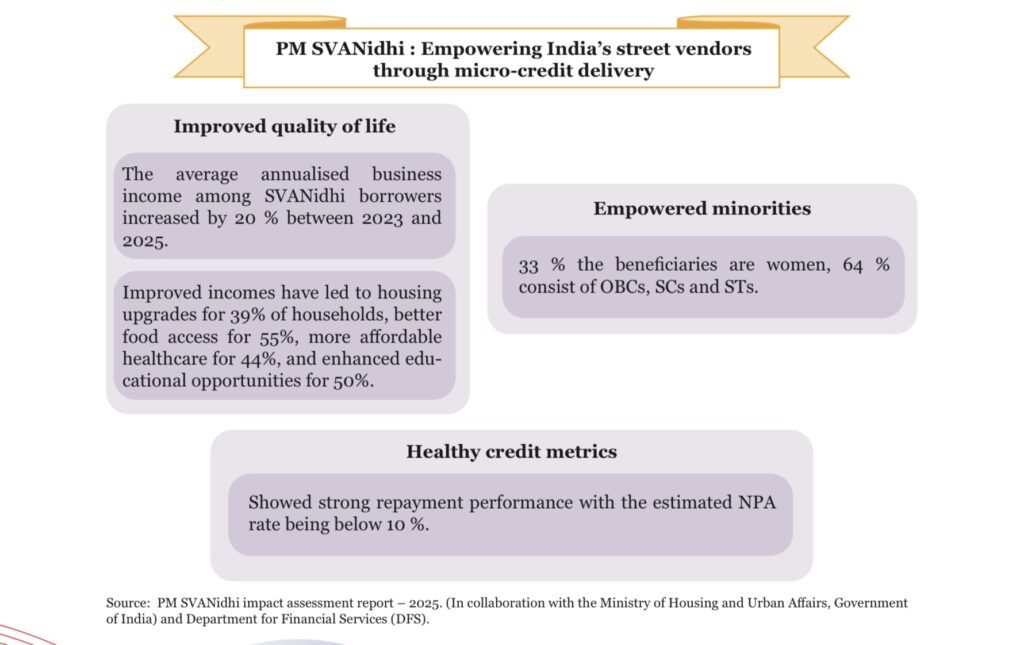

Monetary Management & Financial Intermediation: Refining the regulatory touch

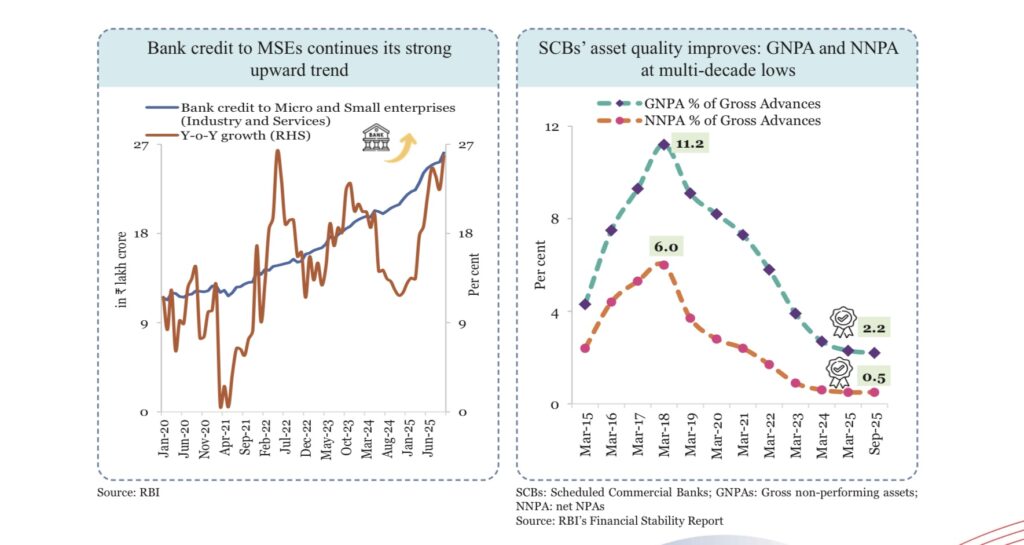

- Banking Health: Asset quality is at multi-decade lows; Gross NPAs (GNPA) fell to 2.2% and Net NPAs (NNPA) to 0.5% as of September 2025.

- Credit Growth: Bank credit to Micro and Small Enterprises (MSEs) continues a strong upward trend, accelerated to 14.5% by December 2025.

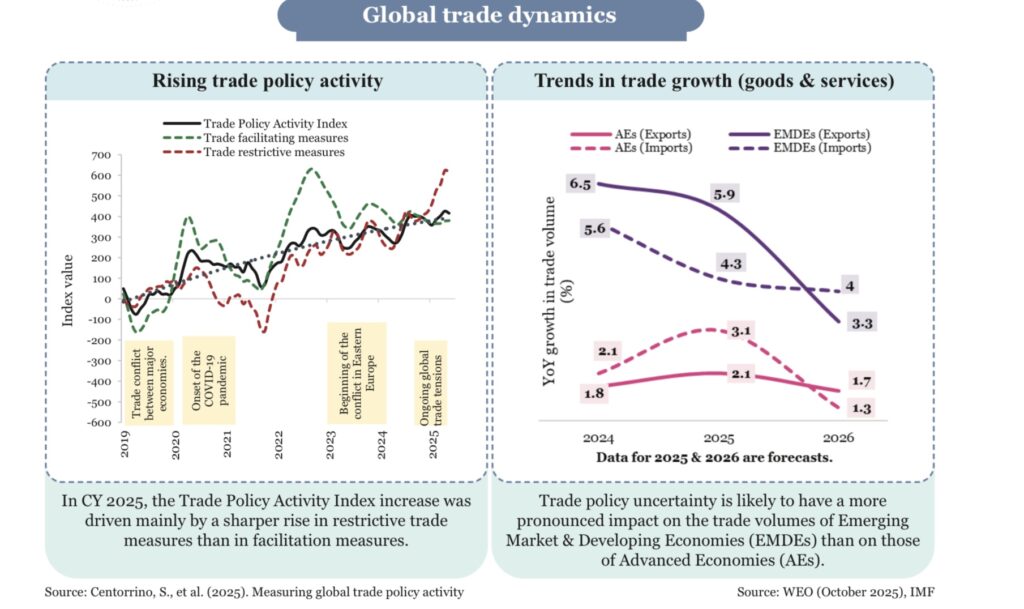

External Sector: Playing the Long Game

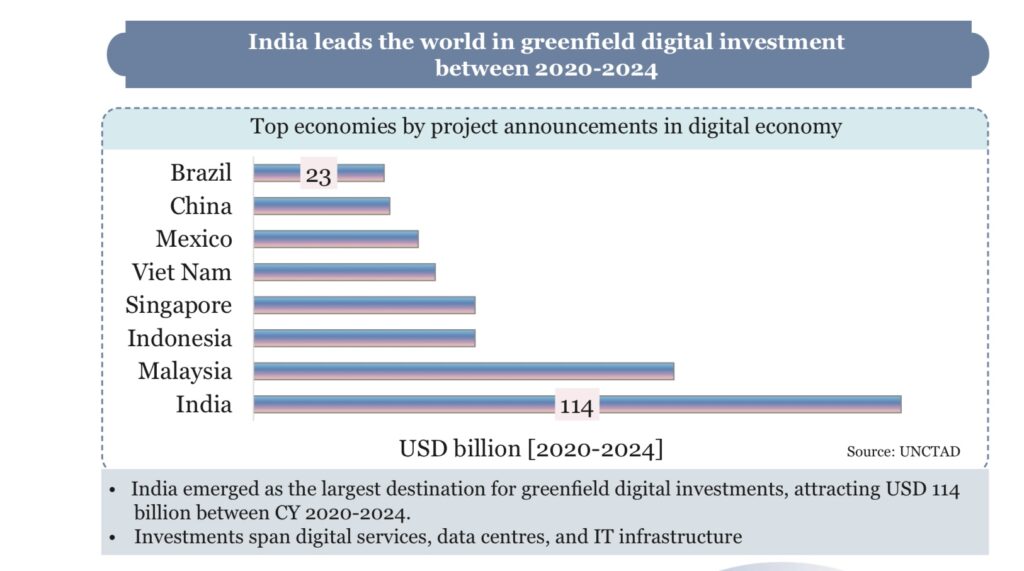

- Global Positioning: India is the top destination for greenfield digital investment, attracting $114 billion between 2020 and 2024.

- India’s share in global merchandise exports has nearly doubled, rising from 1% in 2005 to 1.8% and service export share rose from 2% to 4 % in 2024.

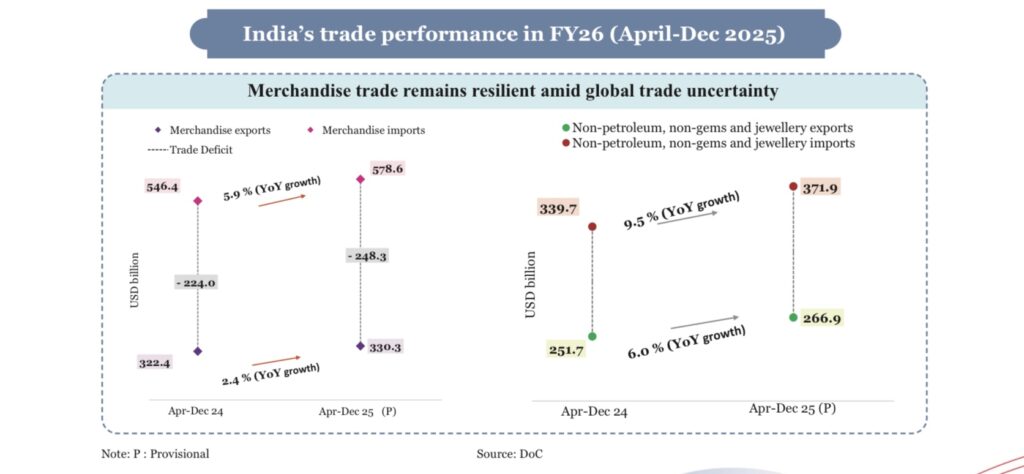

- Trade Resilience: Merchandise trade remains steady despite global uncertainty, with non-petroleum/non-gems exports growing by 6.0% (YoY) in H1 FY26.

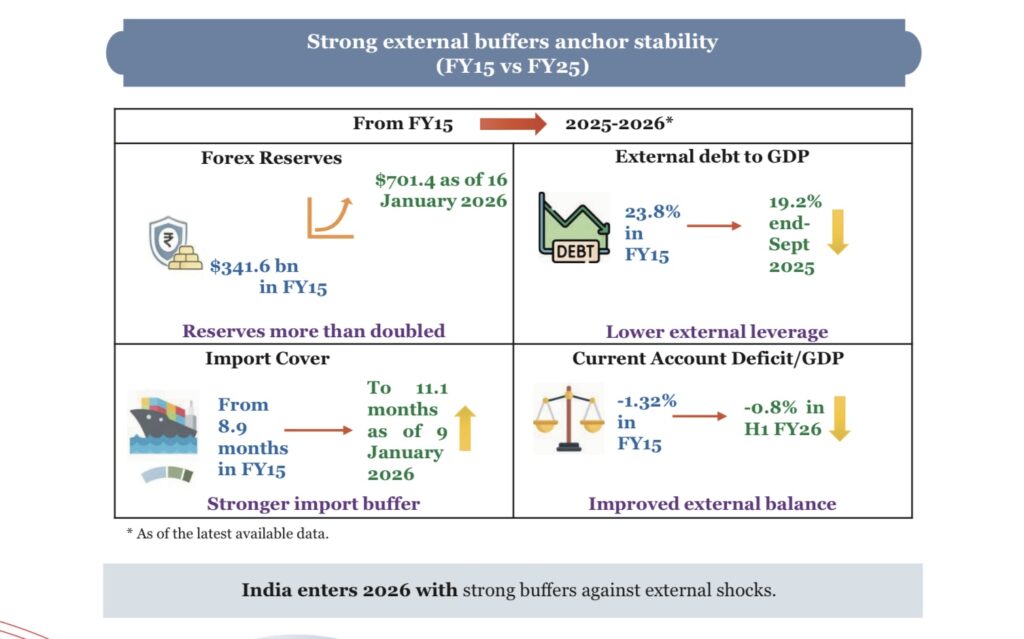

- Strong Buffers: Forex reserves reached $701.4 billion as of January 2026, providing 11.1 months of import cover.

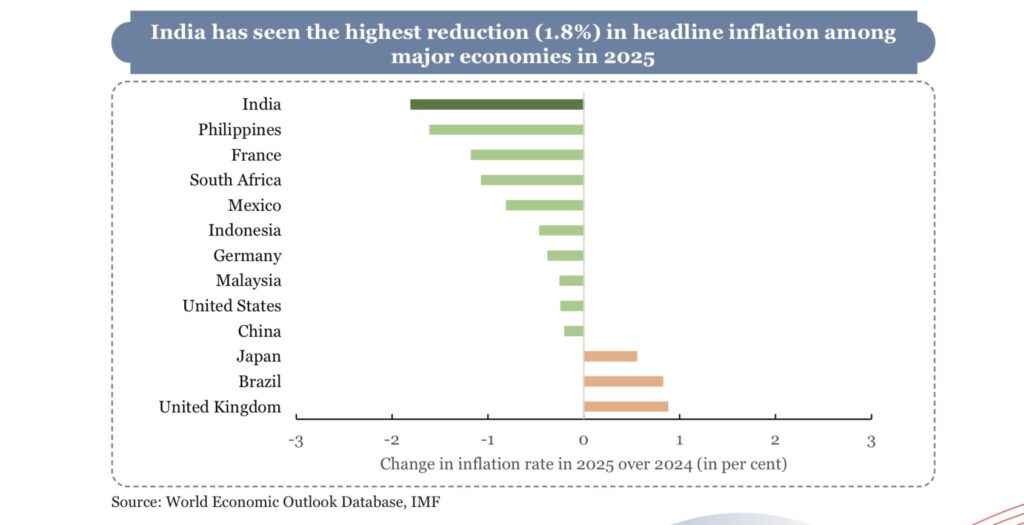

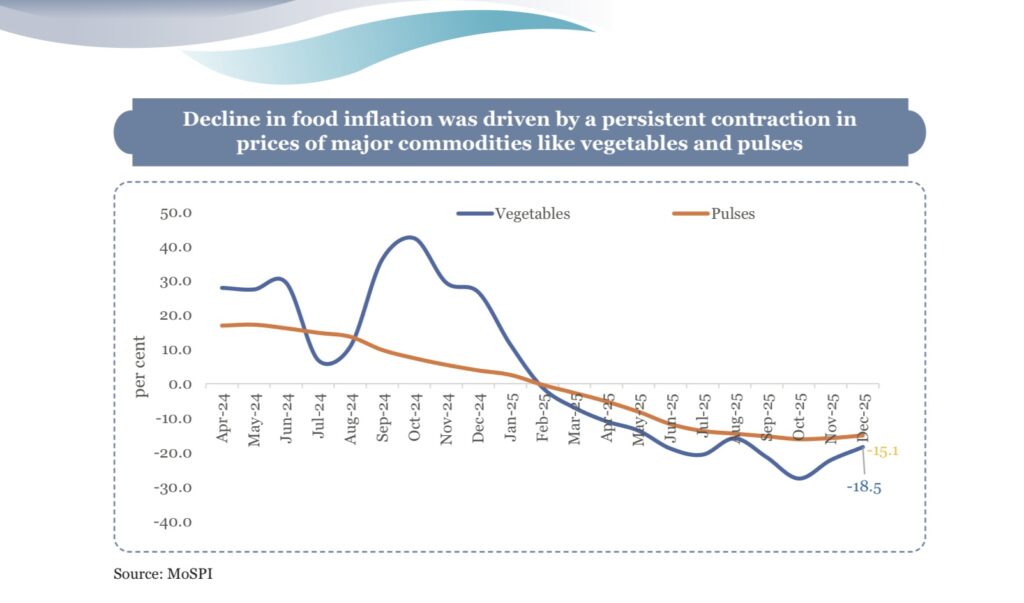

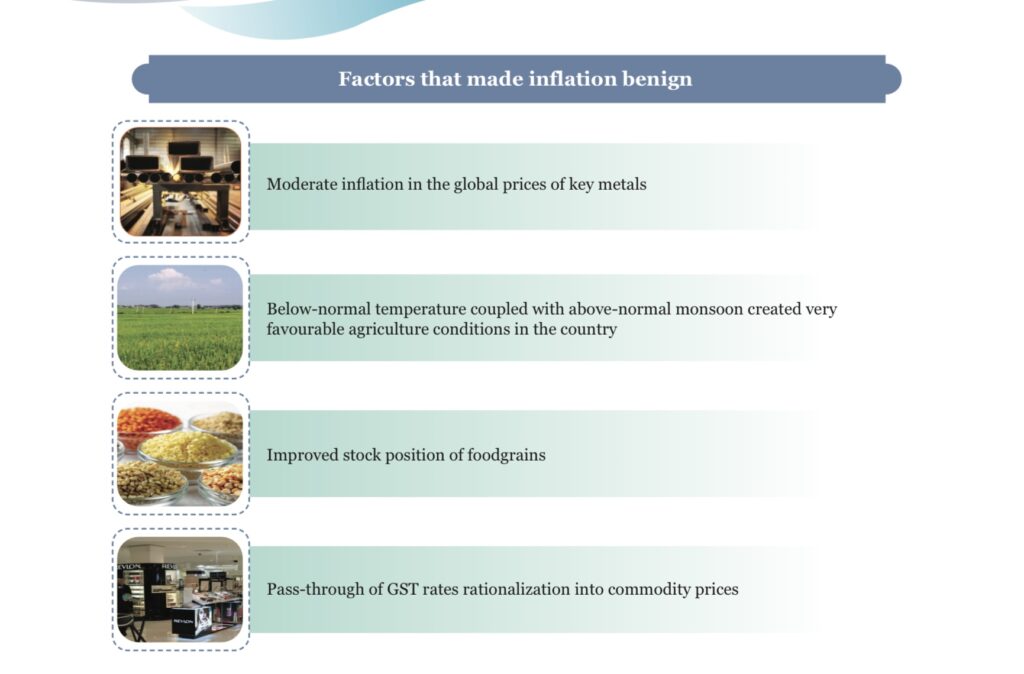

Inflation: Tamed and Anchored

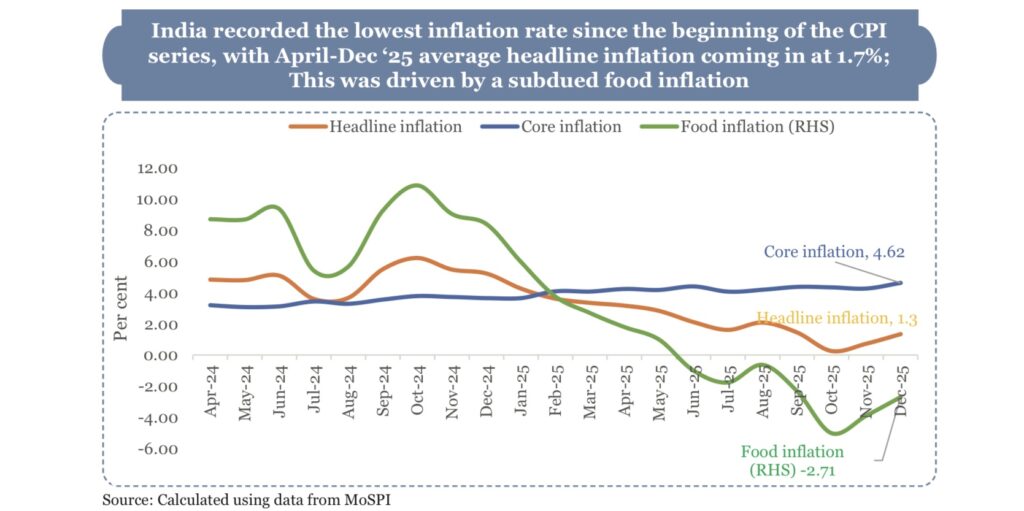

- Average headline inflation for April–Dec 2025 came in at 1.7%, the lowest since the beginning of the CPI series. This was largely driven by a persistent contraction in the prices of vegetables (-18.5%) and pulses (-15.1%) by December 2025..

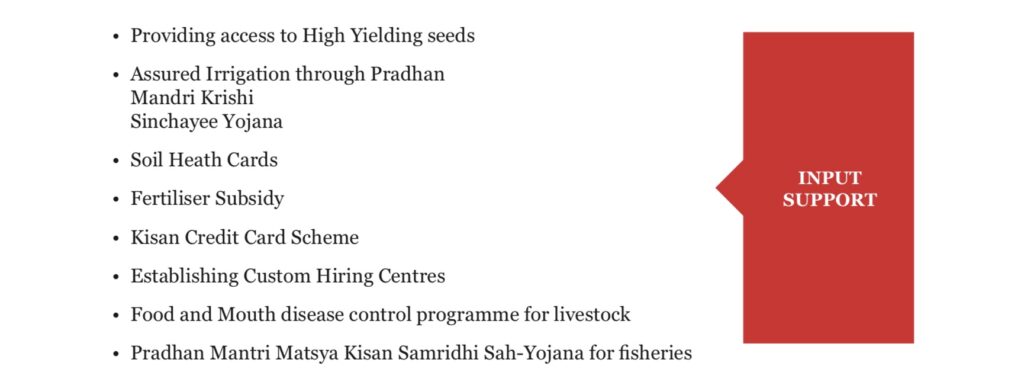

Agriculture & Food Management

- While the overall sector grows at 4.7%, Fisheries (7.2%) and Livestock (6.1%) are the fastest-growing sub-sectors.

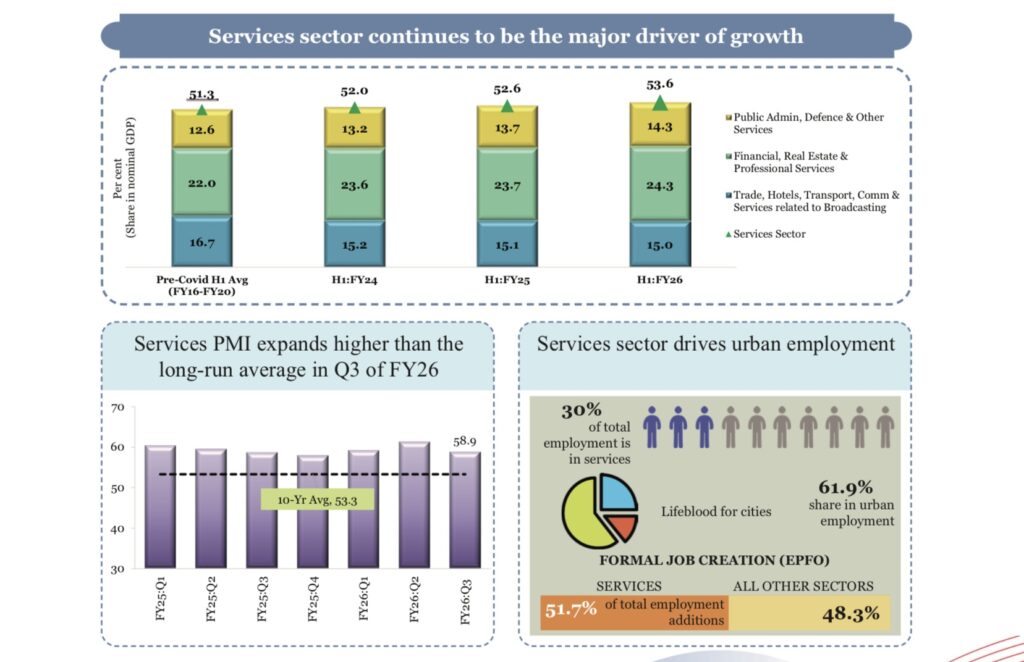

Services: From Stability to New Frontiers

- GDP Contribution: Services sector accounts for 53.6% of India’s GDP.

- GVA Share: The sector represents 56.4% of the Gross Value Added (GVA), marking its highest-ever share and reflecting a definitive shift toward a service-led economic structure.

- Urban Employment: The sector is the lifeblood of cities, providing 61.9% of urban employment.

- Software services and professional consulting grew at 13.5% and 25.9% respectively (FY23–FY25).

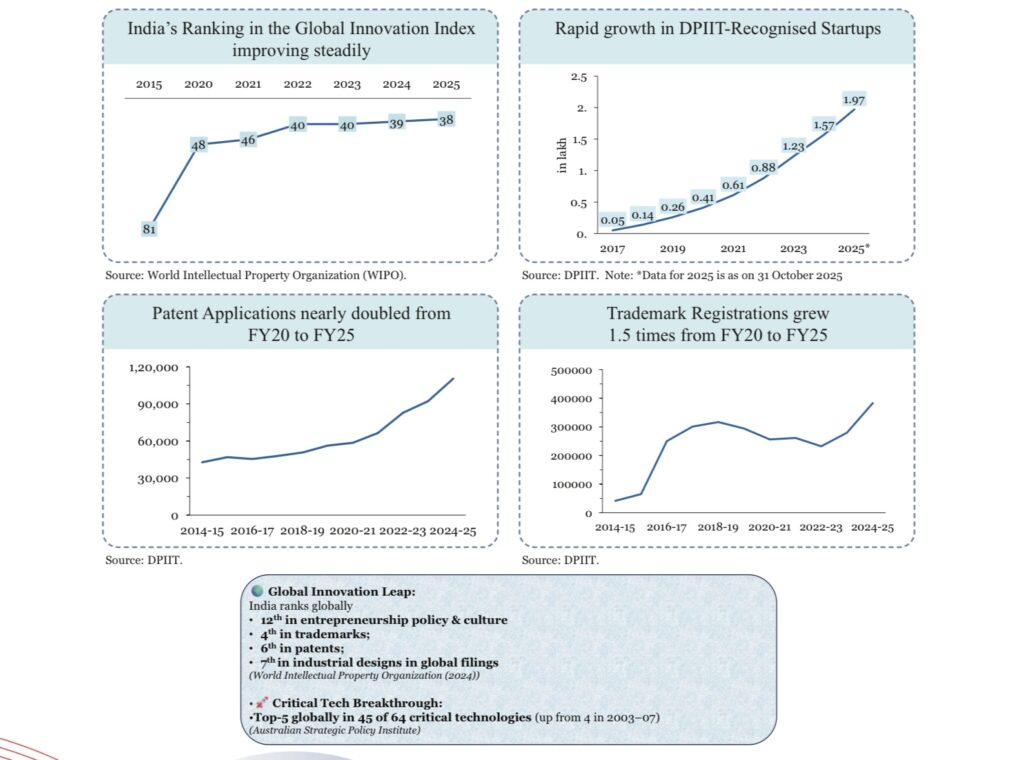

Industry’s Next Leap: Structural Transformation and Global Integration

- India’s Global Innovation Index rank improved from 81 (2015) to 38 (2025).

Investment and Infrastructure: Strengthening Connectivity, Capacity and Competitiveness

- Central government capital expenditure has increased more than four times since FY18. For the current fiscal year, capital expenditure has reached a record ₹11.21 lakh crore (FY26 BE).

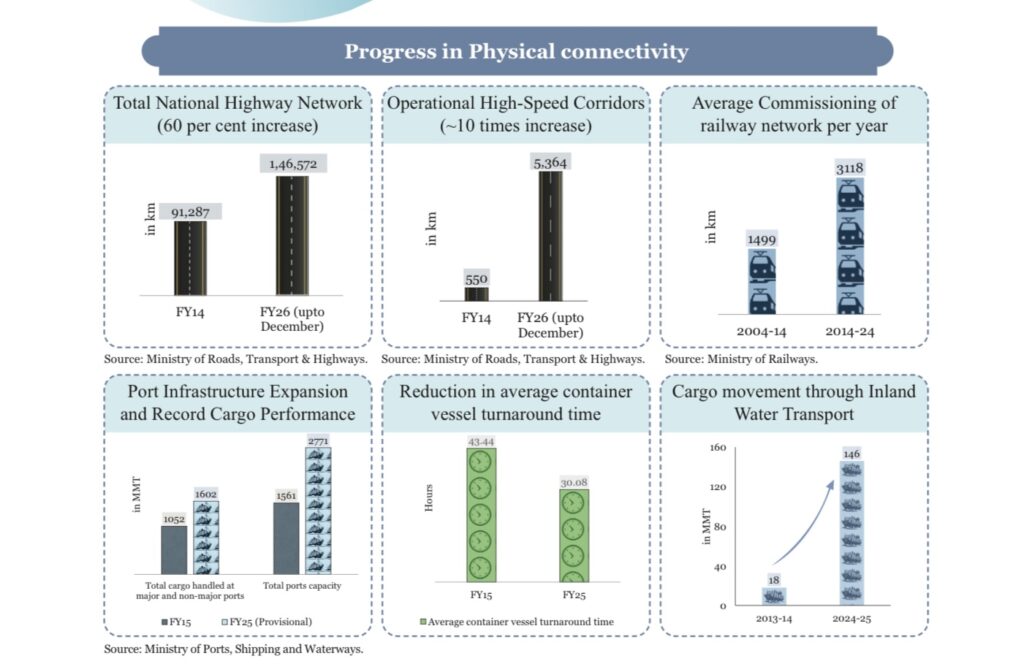

- National Highway network expanded by 60% since FY14.

- Over 81% of rural households now have tap water connections under the Jal Jeevan Mission.

- High-speed highway corridors have expanded nearly ten-fold, growing from pre-2014 levels to 5,364 km by December 2025.

- India has emerged as the 3rd largest domestic aviation market in the world.

- The number of operational airports has more than doubled in a decade, increasing from 74 in 2014 to 164 in 2025.

Environment and Climate Change

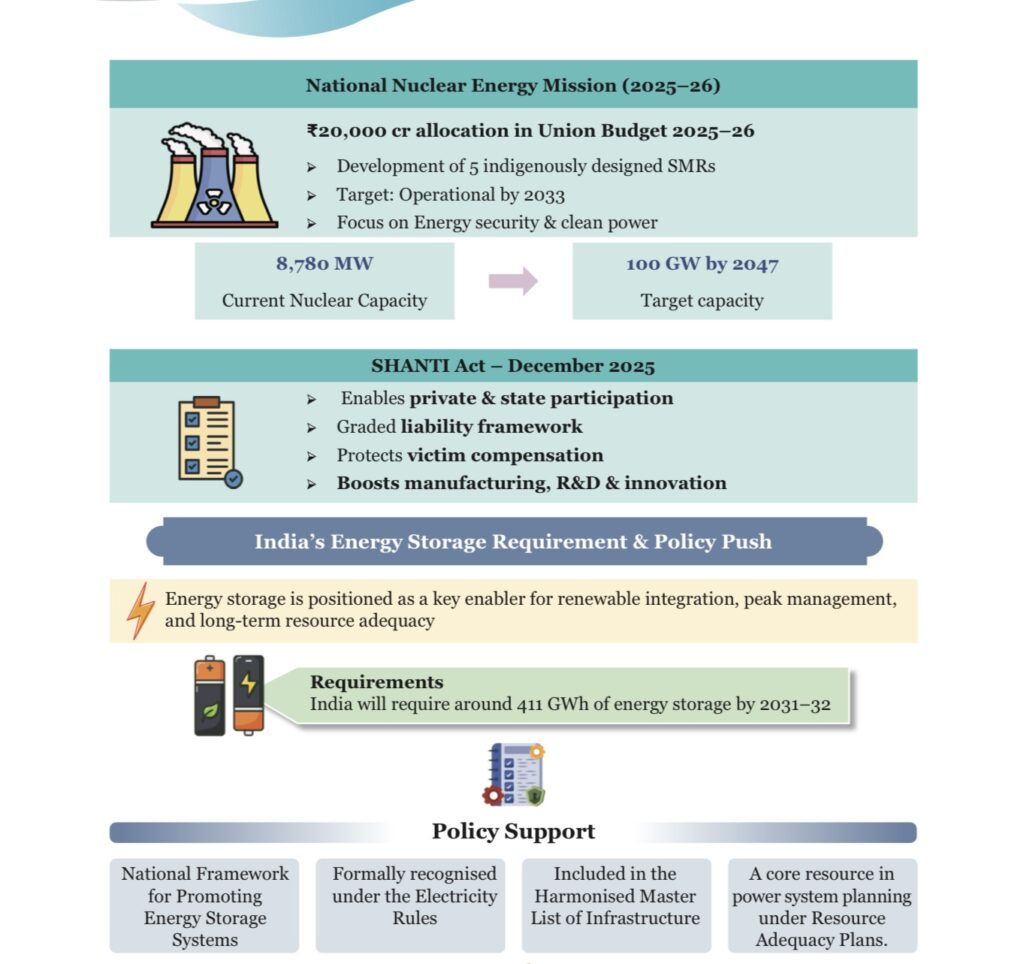

- Target for nuclear capacity is set at 100 GW by 2047.

- A focus on the “Resource Intensity Challenge” highlights that 1 GW of solar power requires approximately 10,252 tonnes of aluminum.

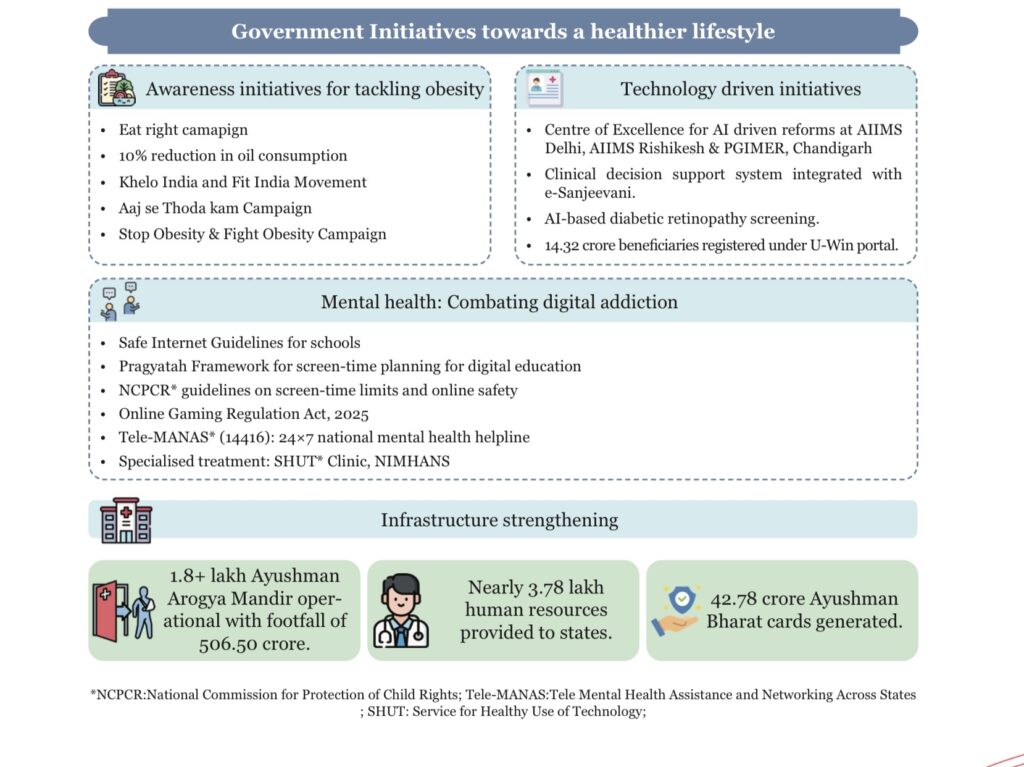

Education and Health: What Works and What’s Next

- Education Enrolment: 4.46 crore students are now enrolled in higher education.

- Health Outcomes: Infant Mortality Rate (IMR) dropped by 37% over the past decade.

- Life expectancy reached 70.3 years in 2023 compared to 49.7% in 1976.

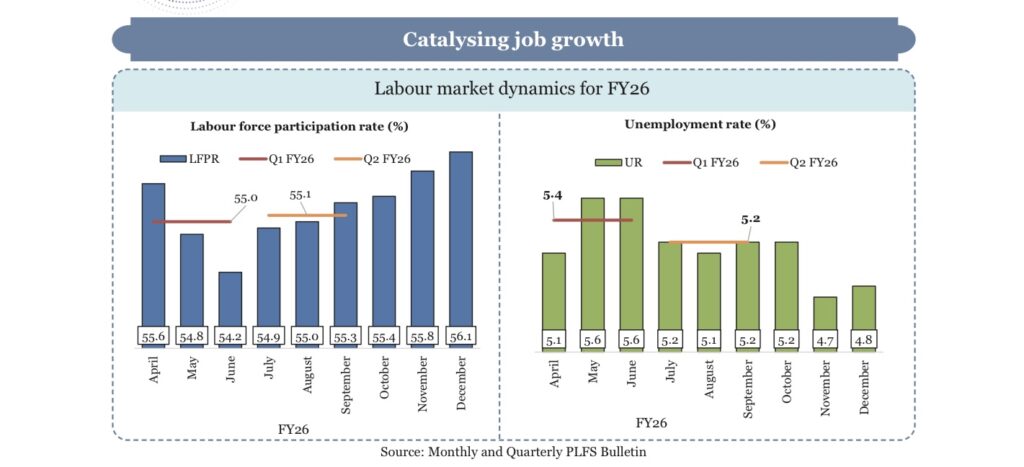

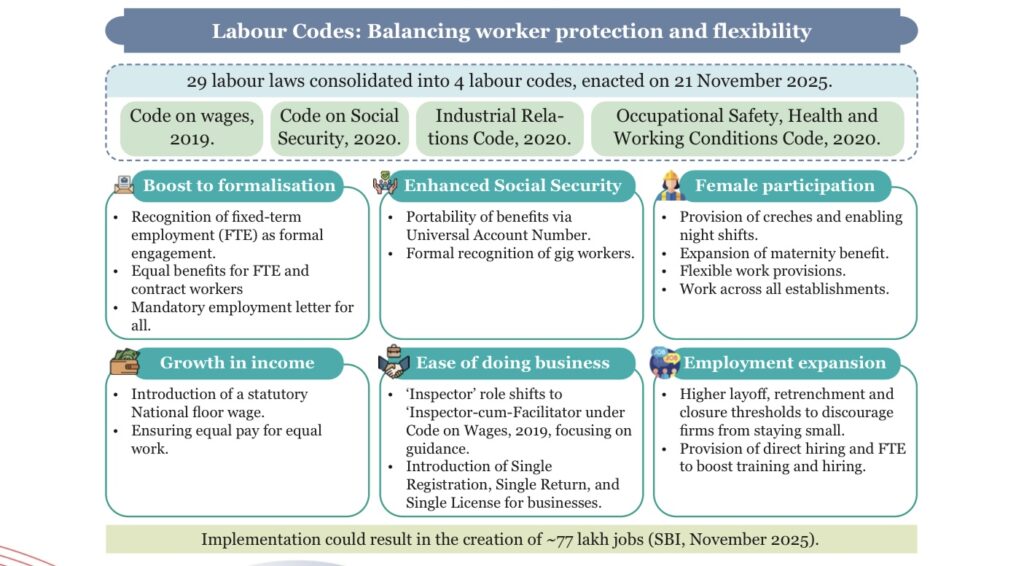

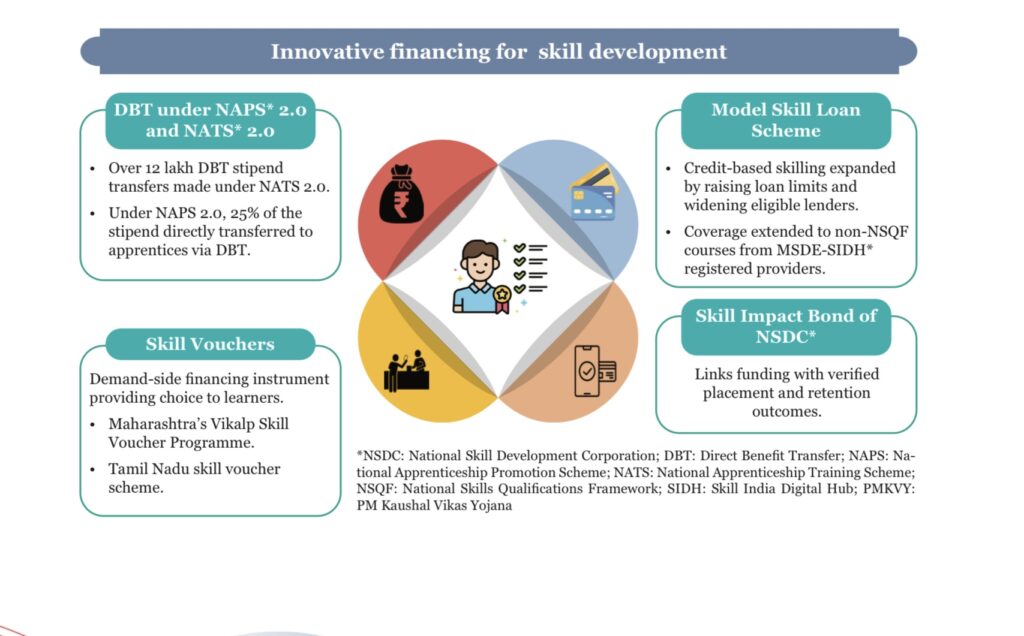

Employment and Skill Development

- The female Labour Force Participation Rate (LFPR) saw a massive jump from 23.3% (2017-18) to 41.7% (2023-24).

- New labour codes consolidated 29 laws into 4 codes to balance worker protection with flexibility.

Rural Development and Social Progress

Poverty Reduction: Extreme poverty is down to 5.3% (2022-23) at the $3.0/day international poverty line.

Evolution of the AI Ecosystem in India: A Way Forward

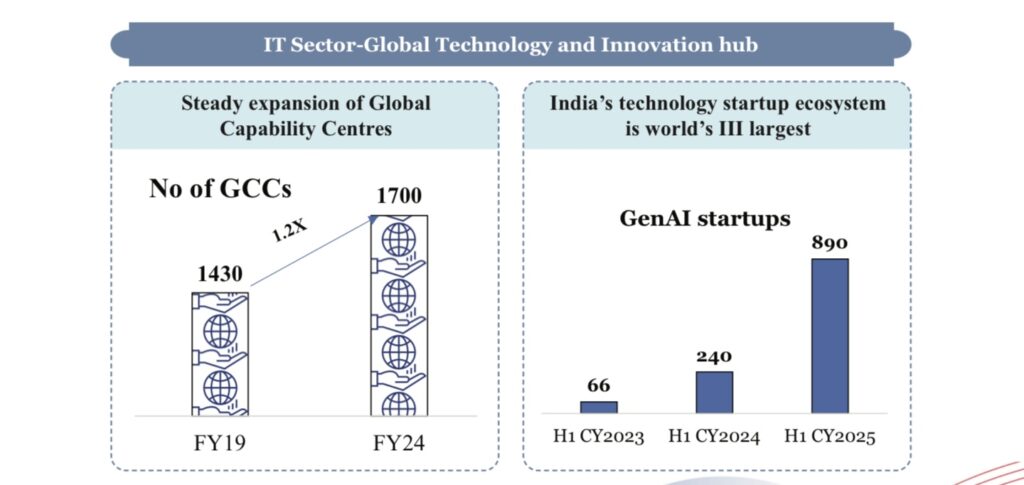

- GenAI startups in India expanded from 66 (2023) to 890 in H1 CY2025.

- Karnataka hosts nearly 39% of India’s GenAI startups followed by Maharashtra at 14%, Delhi at 9% and Telangana at 7%.

Urbanisation: Making Cities Work

- India’s Floor Space Index (FSI) remains lower than global peers; increasing FSI is key to reducing urban sprawl.

- Mobility: Metros, RRTS, and e-buses are being expanded to address the 76–117 hours lost annually by commuters in major cities.

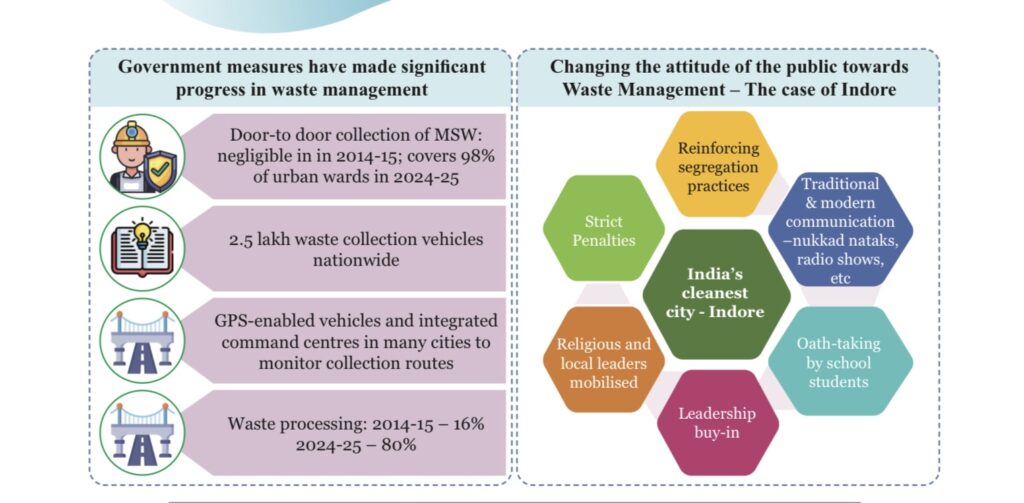

- Waste Management: Door-to-door waste collection now covers 98% of urban wards.

LUCENT IAS Mains Practice Question

Q.India is transitioning into the ‘diabetic capital of the world,’ a trend largely attributed to the unhindered growth of the ultra-processed food market.” In light of the Economic Survey 2025-26, critically examine the socio-economic impact of UPFs and suggest a robust regulatory framework to address this crisis. (Write in 250 words) 15

Watch the full analysis on YouTube

About Lucent IAS

Lucent IAS is a premier coaching institute in Guwahati, dedicated to empowering APSC aspirants with a result-oriented approach. Recognized as a top destination for APSC Coaching, we offer comprehensive guidance ranging from Foundation Courses and Advanced Mains preparation to our signature Assam-Centric study modules. With expert faculty, small batch sizes for personalized mentoring, and the acclaimed Saadhana Test Series, Lucent IAS is committed to helping you crack the Civil Services Examination.

Start your journey to success today. Visit us at lucentias.com or call +91-6913007777 for more details.